CASE STUDY

Founded in 2011, Day One Capital is a venture capital fund based in Budapest, Hungary that uses Investory as their portfolio monitoring tool. The firm is an early-stage technology investor, managing privately financed funds, that seeks to find and join the most exciting Central Eastern European teams on their global mission.

How a small team can benefit from a portfolio monitoring tool

Running a business with small to medium sized teams can be a roller coaster experience. With limited resources, it’s hard to fit all the work in. On the other hand, more people require more communication, meaning more bureaucracy gets in the way. Thus choosing the right tools is crucial to free your team to focus on parts of the business they enjoy, which often keeps your business running. And running a successful VC fund is no exception. As András explains:

Building and managing a single source of truth through our portfolio required a lot of effort from our relatively small team.

As an end-to-end portfolio monitoring solution, Investory fosters effective investment tracking between Day One Capital and their startups. Being up to date is one of the most important things a company can do – creating a ‘single source of truth’ for your fund, enabling team members, LPs, and portfolio companies to stay connected in real time and enable transparency and informed decision making. András adds: “We use Investory in our weekly portfolio meetings instead of going through complicated, easy to break Excel files.”

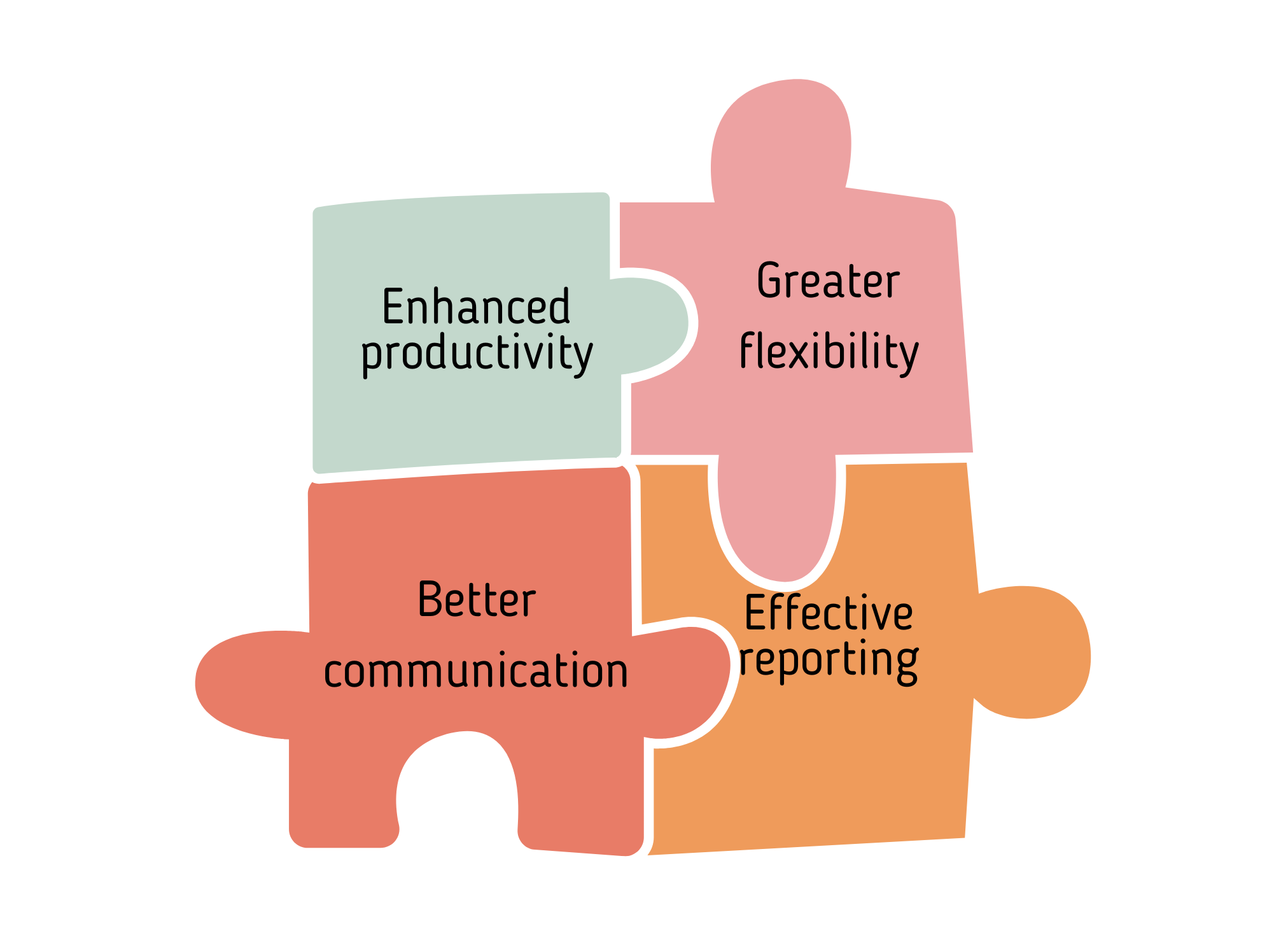

Additional benefits include:

Work smarter, not harder

At Investory, we help customers ‘work smarter, not harder’ and our customer success stories highlight the efficiency savings that our platform enables. If you’re keen to find out how Investory can help you monitor your investment portfolio, schedule a short introductory call.

Read Also

Get a Demo

Request a demo with investory.io to automate your portfolio management process.

Sign Up

Tour the product and try our advanced features with up to 3 portfolio companies.